AUCTION PURCHASE UNDER IBC AND DRT IN INDIA :

“Law makes a clear distinction between a stranger (third party purchaser) and a decree-holder purchaser at a court auction. The strangers are protected for being neither a necessary or connected party to the suit/decree. The basic principle behind the said protection is that the court sales would not fetch market value or fair price of the property, until that is offered.”

A bona-fide auction purchaser is offered a distinct status than a decree-holder purchasing that particular property. The right/interest of the auction purchaser over that property is retained, irrespective of such decree being set aside. The said principle was opined and affirmed in the case of Nawab Zain-ul-abdin Khan v. Mohd. Asghar Ali Khan [1887-15-IA 12]{Privy Council} and Gurjoginder Singh v. Jaswant Kaur [1994 (2) SCC 368] respectively.

The court has the power to consider the fair value of the property, the amount to be produced by the purchaser, formation of a syndicate, and other related factors. Further, it is the court that is responsible to provide protection to the third party auction purchaser.

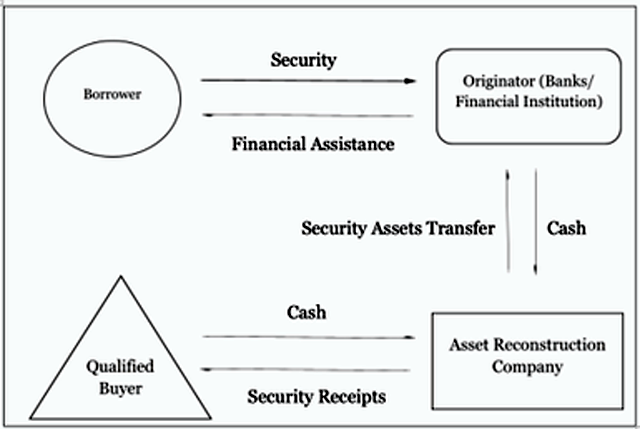

The Concept of Auction under the SARFAESI Act, 2002 :

“An Act to regulate securitization and reconstruction of financial assets and enforcement of security interest and to provide for a Central database of security interests created on property rights and for matters connected therewith or incidental thereto”

Preamble of the Act states that –

When does the concept of auction come into picture ?

Section 13 of the SARFAESI Act, 2002 entitles the secured creditors to recover their debts by way of auction/sale, which are generally done on “as is where is” basis which means that the asset purchased by the auction purchaser would accompany all its existing rights, obligations and liabilities with it. In case a borrower/ debtor fails to repay any debt or any installment thereof to the secured creditor. The debtor might receive a notice from the secured creditor asking to discharge in full his liabilities within the period of sixty days from the date of notice. In case the debtor/borrower fails to comply with the notice, the secured creditor shall have the liberty to exercise all or any of the rights enshrined under Section 13(4)(a) of the SARFAESI Act, 2002, which deals with the sale of immovable property.

Further, the process of sale of the immovable property of the debtor/borrower has been dealt under Rule 8(5) of the Security Interest (Enforcement) Rules, 2002, which

provides the following methods:

By obtaining quotations from the persons dealing with similar secured assets or otherwise interested in buying such assets; or

By inviting tenders from the public;

By holding company auction; or

By private treaty.

The next step if followed by the authorized officer, who serves a 30-days-notice to the borrower regarding the sale and the secured creditor shall cause a public notice in the Form given in Appendix II-A to be published in two leading newspapers, including one in vernacular language having wide circulation in the locality. The above-notice shall provide all the material information including the encumbrance details to enable the purchaser to judge the nature and value of the property. Further, after the execution of auction/sale, the payment against such transaction is issued in the following manner :

Earnest money deposit ( initially during bidding )

25% of the sale amount after successful bidding

Remaining 75% balance within 15 days of the auction/sale.

The Concept of Auction under the Insolvency & Bankruptcy Code, 2016

Preamble of the Act states that –

“An Act to consolidate and amend the laws relating to reorganization and insolvency resolution of corporate persons, partnership firms and individuals in a time bound manner for maximization of value of assets of such persons, to promote entrepreneurship, availability of credit and balance the interests of all the stakeholders including alteration in the order of priority of payment of Government dues and to establish an Insolvency and Bankruptcy Board of India, and for matters connected therewith or incidental thereto”

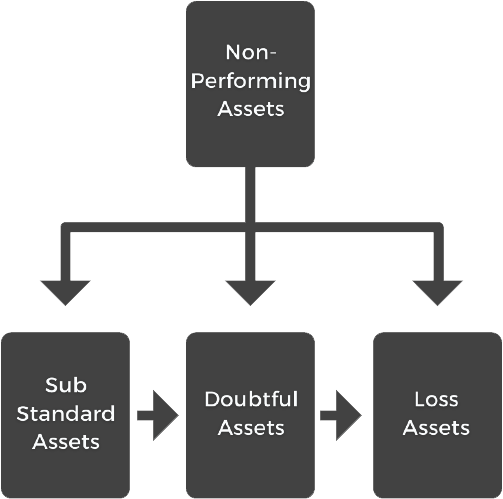

The Concept of NPA :

The Ghosh Committee in the year 1985 recommended a system for classifying the assets, known as the ‘Health Code System’. Based on the said system, the loan accounts were divided into 8 sub-categories specified under the system. However, the system had several loopholes and was eventually set aside on the recommendation of Narsimham Committee for not being consistent with the international standards. Now, the non-performing assets are classified into 3 subcategories.

The basic difference between the non-performing assets and stressed assets is the time elapsed from the stipulated time of repayment of the debt. As in case of NPAs, the principal amount or its interest or both remains outstanding post-ninety days of the loan repayment term, while in case of stressed assets, the debt amount remains outstanding post-thirty days of the loan repayment term. Therefore, with span of time a stressed asset may turn into a non-performing asset.

THE PROCESS OF AUCTION OF UNDER THE IBC, 2016:

Under the IB Code, assets of corporate debtor are sold through e-auction on “as is where is” and “as is what is” basis. The liquidator may

(a) sell an asset on standalone basis

(b) sell

(i) the assets in a slump sale

(ii) a set of assets collectively, or

(iii) the assets in parcel; or

(c) sell the corporate debtor as a going concern.

The procedure for conducting e-auction is stipulated under the Liquidation Process Regulations, 2016 (Amended up to 30.09.2021):

The liquidator releases a e-auction sale notice with all the necessary particulars;

The intending bidders before submitting their bids shall inquire about the property independently;

The bidders are required to deposit the Earnest Money Deposit (EMD) and submit its proof along with other required documents to the liquidator;

A Letter of Intent shall be issued to the successful bidders within 7 days of declaration, who shall deposit the remaining amount within 30 days (and in any However if the liquidator is of the opinion that a physical auction is likely to maximize the realization from the sale of assets and is in the best interest of creditors, he may sell the assets through a physical auction after obtaining the permission of the Adjudicating Authority.case not later than 90 days after issuance of LOI)

Rights and liabilities of the auction purchaser and seller :

- Jai Logistics v. The Authorized Officer, Syndicate Bank (MANU/TN/1161/2020) – The Hon’ble Madras High Court held that the purchaser holds a right to be informed about all the encumbrances, from the Respondent Bank or Financial

Institution w.r.t proposed property offered for sale. - V. Sambandan v. The Punjab National Bank (MANU/TN/3041/2009) – The Hon’ble Madras High Court opined that as the purchaser is not compelled to take part in the auction, therefore, the onus to verify the particulars of the

proposed property is on the purchaser. - United Bank of India v. Official Liquidator & Others (MANU/SC/0592/1994) – The Hon’ble Supreme Court held that provision of the Security Interest (Enforcement) Rules, 2002 mandates the secured creditors to set all the information which in the eyes of authorized officer are material to ascertain the nature and value of the property.

- Chemstar Chemicals & Intermediates (P) Ltd. v. The Commercial Tax Officer Chennai and State Bank of Mysore

The Hon’ble Madras High Court held that the purchaser must be made aware of the order of attachment, if any and encumbrances w.r.t proposed property as the same is likely to influence the decision of the auction purchaser.