THE CONCEPT OF CORPORATE RESTRUCTURING :

“Corporate restructuring is one of the mechanisms that can be waged to encounter the challenges and problems which confront business. The law should be slow to retard or impede the discretion of corporate enterprise to absorb the needs of changing times and to cater the demands of increasing competition. The law as evolved in the area of mergers, and amalgamation has recognized the importance of the Court not sitting as an appellate authority over the commercial wisdom of those who seek to restructures business.” -Justice Dhananjay Y. Chandrachud, In Ion Exchange (India) Ltd. re, (2001) 105 Comp Cases 115 (Bom)

With the scaling down of the import/export barriers and existence and easy access of multinationals in our domestic market, the prevailing growth mantra can be coined as ‘beat them or join them’. The most desired fulcrum in the business sector is coined as ‘Growth’, which can be hired by eliminating the competitors and gaining higher market share.

Corporate combinations have emerged as an interesting area of study for the financial analysts and the accounting community. Synergies are regarded as one of the most celebrated reasons behind merger/amalgamation.

The first wave of combination or merger was witnessed post the period of economic expansion, and a significant attribute was the contemporaneous consolidation of manufacturers falling under same industry (Sudi Sudarsanam (2003) (Emiretus Professor of Finance and Corporate Control, City University Business School, London). These consolidations resulted in horizontal consolidation of major industries that led to the creation of the first giants in the oil, mining and steel industries, among others.

REGULATORY FRAMEWORK

The law in India provides for a regulatory framework to ensure that mergers are in public interest and do not create a monopoly. the various acts and regulations which provide for a regulatory framework are :

- Companies Act, 2013, (Sec 230-240)

- SEBI (LODR) Regulations, 2015, (Reg. 11, 37 and 94), for listed entities.

- Accounting Standard – 14

- FEMA (in case of merger of companies having foreign capital)

- Prior approval of RBI in case of cross-border merger

- Competition Act, 2002

- Income Tax Act, 1961

- Indian Stamp Act, 1899

- Sectoral-regulatory approval, IF ANY

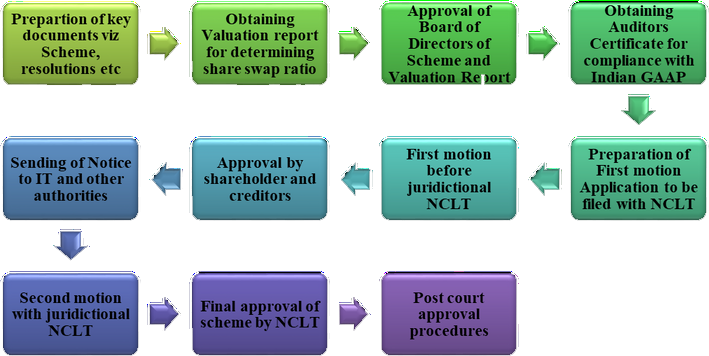

PROCEDURE TO BE FOLLOWED FOR MERGER

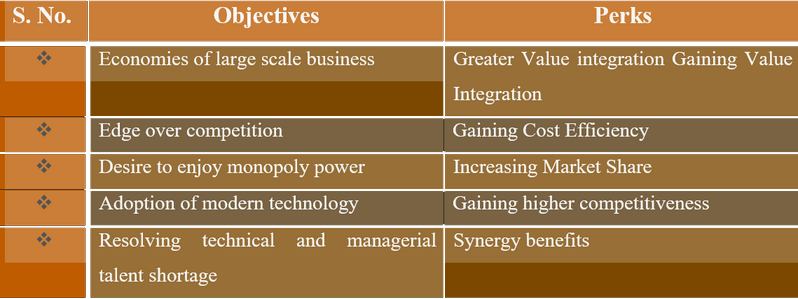

WHY DO COMPANIES MERGE OR AMALGAMATE ?

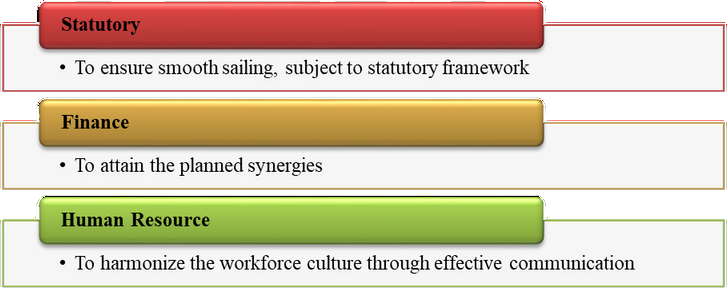

POST MERGER INTEGRATION- AN OVERVIEW

- Obtaining authenticated/ certified copy of NCLT order sanctioning the scheme.

- Filing NCLT order sanctioning scheme in Form INC 28 by each of the Transferor Companies and the Transferee Company with the Registrar of Companies. (the scheme generally becomes effective on this day)

- Conduct of Board meeting of Transferee Company (i) to take on record the NCLT order and note the effectiveness of the Scheme, (ii) to fix Record Date for determining the list of shareholders of Transferor Company for issuance of shares of Transferee Company pursuant to the Scheme (iii) to take note of the revised authorized share capital and paid up capital in the MOA and AOA of the Transferee Company (iv) to take note of the amended objects clause in the MOA (only if the objects clause is getting amended), and (v) for giving general authorizations for filling of e-forms with the MCA.

- Transferee Company to file an application with the Registrar along with the scheme registered, indicating the revised authorised capital and pay the prescribed fees due on revised capital or get adjustment.

- Procuring list of shareholders as on Record date from RTA to whom shares have to be allotted.

- Conduct of Board meeting for Allotment of new shares of Transferee Company to shareholders of Transferor Company pursuant to Scheme and filing of prescribed form with ROC.

- Signing of Agreements with RTA and with NSDL and CDSL for admitting securities.

- Submission of Corporate Actions forms with Depositories for credit of shares in the shareholder’s account.

- Printing of Merger Order and Scheme and attaching to every copy of MOA.

- In case of company shares being listed, Intimation to Stock Exchanges.

- Statement of compliance – In relation to the order u/s 232(3) shall until the full scheme is implemented file a statement with ROC every year duly certified by a CA/CMA/CS in practice indicating whether the scheme is being complied in accordance with the orders of Tribunal or not within 210

days from the end of each financial year. - If the objects or name of the company is changed, MOA to be altered and

necessary ROC filings to be complied with. - Filing of Form FC-GPR filing where foreign capital is involved.

- Valuation of per equity share and filing of Scheme along with the NCLT order for adjudication with the relevant stamp authority.

Scheme related intimation/filings with various regulatory authorities such as the tax, labor etc. and updating of records.

POST-MERGER INTEGRATION:

ROLE AND JURISDICTION OF COURT IN A MERGER/ AMALGAMATION :

IN MIHEER H. MAFATLAL V. MAFATLAL INDUSTRIES LTD. [JT 1996 (8) 205]

Whether the court has jurisdiction to scrutinize the scheme when the same is approved by majority of the creditors or members or their respective classes ? The Hon’ble court observed that the Court cannot, undertake the exercise of scrutinising the scheme placed for its sanction with a view to finding out whether a better scheme could have been adopted by the parties. This exercise remains only for the parties and is in the realm of commercial democracy permeating the activities of the concerned creditors and members of the company who in their best commercial economic interest by majority agree to give green signal to such a compromise or arrangement.

IN RE CONSOLIDATED COFFEE LIMITED [(1999) 97 COM CASES 1 (KAR)]

In case of petitions for sanctioning scheme in two different courts/states, Can different orders be passed for the scheme ?

The Hon’ble courts observed that merely because a petition for sanction is pending before another High Court it is not a ground on which the Court should be requested to defer the decision until that case was heard.

MEL WINDMILLS PVT. LTD. VS. MINERAL ENTERPRISES LTD & ANR (2019).

Whether the merits of the scheme be considered at the application stage ?

The Hon’ble Tribunal observed that it is manifestly clear that at the stage of calling of meeting of creditors/members for consideration of the scheme of compromise or arrangement the Tribunal is not required to examine the merits of the scheme qua the proposed compromise/ arrangement. Any such indulgence on the part of Tribunal would fall foul of the provision engrafted in Section 230 (1) of the Act and would be without jurisdiction”

V MARSHALL SONS & CO. INDIA LTD V. ITO [223ITR 809]

Whether the appointed date may precede the date of sanctioning of Scheme by the Courts ?

The Hon’ble Supreme Court held that the appointed date may precede the date of sanctioning of Scheme, the date of filing of certified copy of the Order, date of allotment of shares etc.

Further Sec 232(6) of the Companies Act, 2013 provides that the scheme shall clearly indicate an Appointed date.

Where appointed date chosen is a specific calendar date, it may precede the date of filing the Application, but not beyond a year unless justification brought out in the scheme.

HINDUSTAN LEVER LIMITED V. STATE OF MAHARASHTRA (2003, SC)

Whether the order sanctioning the Scheme an Instrument for the purpose of Stamp Act ?

The Hon’ble Supreme Court held that an order sanctioning an amalgamation is an Instrument within the meaning of the Stamp Act and is therefore liable to pay stamp duty as prescribed by the Act on conveyance of property.

States of Maharashtra and Gujarat are the frontrunners to have specifically amended the Stamp Act and included the order of amalgamation in the definition of “conveyance”.

DISCLAIMER

This Article is just for information purpose only and shall not be considered as legal opinion/advice.

DRAFTED AND SETTLED BY :

VARUN S AHUJA & HARVINDER SINGH

ADVOCATES AND PARTNERS